Asset Limits for Safety Net Programs

Increasing the amount of savings that families can have under public assistance.

Economic Justice – Policy Reform

OVERVIEW

Public assistance programs can be essential to providing temporary help for families who are facing difficult financial circumstances. Washington State had strict asset limits for public benefits programs which had not been adjusted since 1996. These requirements limited those on programs to no more than $1,000 in cash-assets of any kind – in reality, far less than a month of living expenses for families – and a car worth no more than $5,000. This left many families with the choice between owning a car they needed to get to work or receiving the public assistance they needed to stabilize their family and avoid homelessness. Even maintaining a bank account with a few months of funds to cover extra expenses for kids could disqualify a family.

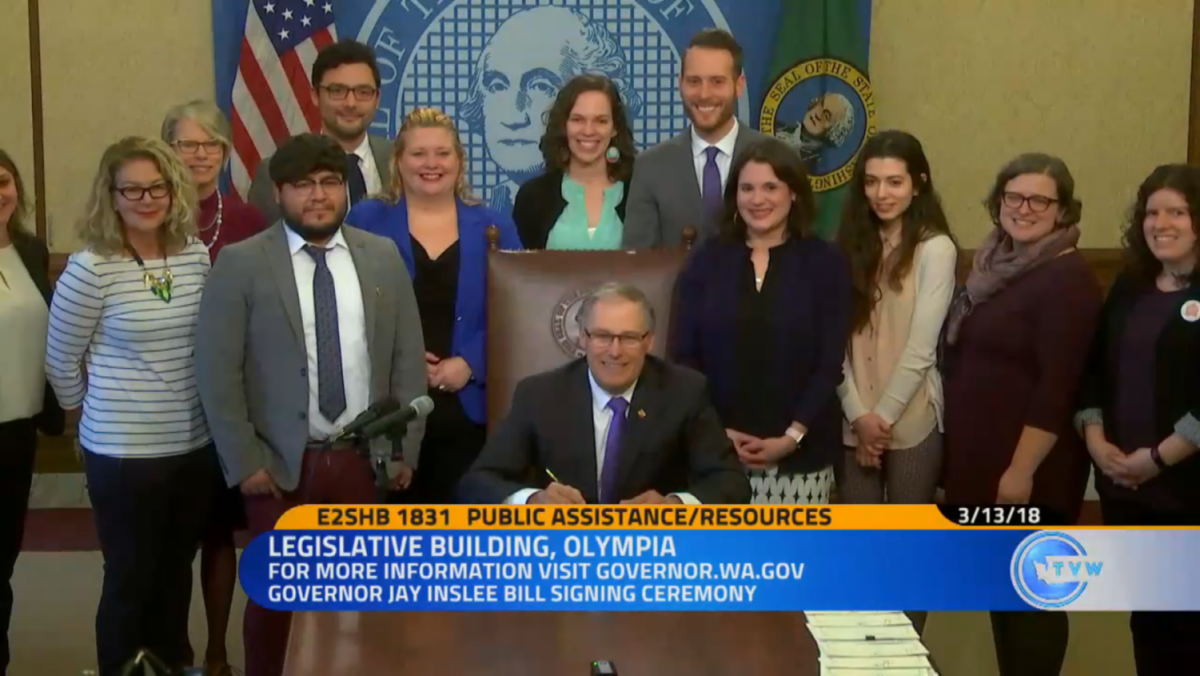

In 2017-2018, Columbia Legal Services led an advocacy effort to help pass Engrossed Second Substitute House Bill 1831. This bill, effective in 2019, will increase the cash asset limit to $6,000 and the car equity limit to $10,000. These changes mean families will save more and build up their assets in order to regain economic security.

“A reliable car is an indispensable tool to help low-income families get to work, to school, to daycare,” said Ann LoGerfo, directing attorney at Columbia Legal Services, in a media release. “Washington law made owning a safe and functioning vehicle a barrier to safety net programs, keeping families from regaining economic security. This bill helps to reduce that barrier. A working vehicle is part of self-sufficiency, not a luxury.” LoGerfo, Staff Attorney Michael Althauser, and Policy Director Antonio Ginatta led this effort.

Washington Governor Signs Law Allowing Families to Receive Government Assistance While Keeping Essential Assets Needed for Self-Sufficiency

Governor Jay Inslee signed into law a bill today that promotes self-sufficiency and savings by raising long outdated asset limits for safety net programs. This bill (ESSHB 1831) allows applicants for public assistance programs to own a vehicle worth up to $10,000 – a reasonable increase from the current allowable limit of $5,000, which hasn’t changed since the mid-1990s. The bill also increases the limits for other resources from $1,000 to $6,000.

Before enacting this bill, Washington was only one of six states that set a vehicle exemption at $5,000 or less. In fact, the majority of states have completely exempted vehicles from consideration in determining eligibility.

The reason for this is simple. “A reliable car is an indispensable tool to help low-income families get to work, to school, to daycare,” said Ann LoGerfo, directing attorney for the Basic Human Needs program at Columbia Legal Services. “Washington law made owning a safe and functioning vehicle a barrier to safety net programs, keeping families from regaining economic security. This bill helps to reduce that barrier. A working vehicle is part of self-sufficiency, not a luxury.”

The increase in assets limits is also significant. Public benefits programs are designed as temporary measures to assist families during difficult times, with a goal of financial stability.

“Requiring spending down cash savings discourages saving in the future, and can throw a family into greater economic insecurity if they face an unexpected expense,” said LoGerfo. “Allowing families to keep essential assets while receiving help actually furthers the purpose of public benefits programs – which is for families to reach a point where help is no longer needed.”

POWER (Parents Organizing for Welfare and Economic Rights) board member Monica Peabody has worked for years with parents in need of assistance, and is pleased that Washington is finally coming into alignment with many other states in allowing families to keep a few essential assets.

“It has never made sense to us that someone in a temporary state of emergency has to sell down all their basic necessities, like a vehicle, savings, retirement account to access some support to get them through the tough spot,” said Peabody. As an example of the situation faced by many families, she noted, “We got a call from a teacher who was fighting cancer. She couldn’t work because her treatment was making her too ill, but this was a temporary situation. She could not access benefits without cashing in her retirement account. It made no sense to her to impoverish herself in the long term for short term assistance when she really needed it. It will save taxpayers a lot of money by providing short term assistance to people in emergency situations without requiring them to take measures that will keep them in poverty and needing support longer.”

Representative Eric Pettigrew (D-Seattle) was the prime sponsor of this legislation. The bill goes into effect February 1, 2019.