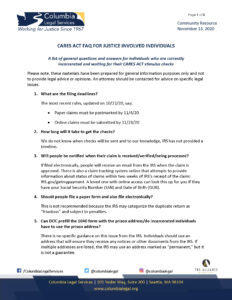

A list of general questions and answers for individuals who are currently

incarcerated and waiting for their CARES ACT stimulus checks

Please note, these materials have been prepared for general information purposes only and not to provide legal advice or opinions. An attorney should be contacted for advice on specific legal issues.

Please note, these materials have been prepared for general information purposes only and not to provide legal advice or opinions. An attorney should be contacted for advice on specific legal issues.

- What are the filing deadlines?

The most recent rules, updated on 10/21/20, say:

- Paper claims must be postmarked by 11/4/20

- Online claims must be submitted by 11/21/20

- How long will it take to get the checks?

We do not know when checks will be sent and to our knowledge, IRS has not provided a timeline.

- Will people be notified when their claim is received/verified/being processed?

If filed electronically, people will receive an email from the IRS when the claim is approved. There is also a claim tracking system online that attempts to provide information about status of claims within two weeks of IRS’s receipt of the claim: IRS.gov/getmypayment. A loved one with online access can look this up for you if they have your Social Security Number (SSN) and Date of Birth (DOB).

- Should people file a paper form and also file electronically?

This is not recommended because the IRS may categorize the duplicate return as “frivolous” and subject to penalties.

- Can DOC prefill the 1040 form with the prison address/do incarcerated individuals have to use the prison address?

There is no specific guidance on this issue from the IRS. Individuals should use an address that will ensure they receive any notices or other documents from the IRS. If multiple addresses are listed, the IRS may use an address marked as “permanent,” but it is not a guarantee.

- Assuming the checks are sent to an individual at their DOC address, what happens when checks arrive? Will DOC distribute those to individuals or have individuals sign over to DOC or otherwise intercept funds? Has DOC explained this to anyone? What if the person is no longer in DOC or in another facility?

Per DOC: Checks sent into facilities will be deposited following the normal process and subject to statutory deductions. As to checks of individuals who no longer are in DOC custody, we believe the Department will send it to the individual’s new address if they have it, or last known address.

- What deductions can DOC take from stimulus funds?

DOC’s position is that checks coming into facilities will be deposited per normal procedure and will be subject to statutory deductions. We believe that DOC will treat the stimulus funds as ‘other funds’ and per their deduction matrix, the funds will be subject to deductions for LFOs, crime victim compensation, savings, child support, cost of incarceration, etc.

Deduction matrix is available here: https://www.doc.wa.gov/information/policies/showFile.aspx?name=200000a2

- If I disagree with the deductions DOC takes from my CARES stimulus funds, who can I contact to challenge that practice?

If people disagree with DOC’s deductions, they should grieve DOC’s action through DOC’s grievance process. They may also want to contact an attorney familiar in tax law for legal advice and consultation.

- If someone gets their check but can’t cash it for a year or more, will the check still be good and if not, what can they do?

Most checks are good for 180 days. US Treasury checks are usually good for a year (see face of check). After that time, a person would need to contact the IRS and request a new check. However, if checks are sent to an individual’s prison address, our understanding is that DOC will treat the checks as they would treat any other funds sent into the facilities and they will be deposited following the normal process. Thus, individuals will not be able to ‘hang on to’ the check until they are released or otherwise able to cash it.

- Can individuals have the checks direct deposited?

The 1040 asks for direct deposit information so you can provide that information. Note that the IRS instructions state that the account must be in the name of the filer who is receiving the stimulus check.

- What happens if you apply and find out that someone else already filed for you, and is there a way to find this out?

There is a website that addresses this, IdentityTheft.gov, and it helps people complete what’s called an IRS Identity Theft Affidavit (IRS Form 14039). To find out if someone has done this, or check the status of your claim, someone can check online for you: https://www.irs.gov/coronavirus/get-my-payment.

For questions, contact Tony Gonzalez, Columbia Legal Services

Attorney, at tony.gonzalez@columbialegal.org.

Recent Comments